2025 Los Angeles Real Estate Market Report

Rates Drop, Buyers Suit Up:

Lower borrowing costs draw buyers back and set the stage for a stronger finish to 2025.

California’s housing market finally caught a little tailwind in August, thanks to mortgage rates sliding to their lowest point in nearly a year. Existing single-family home sales nudged 0.9% higher than July and were essentially even with last August—down a slim 0.2%. The statewide median price came in at $899,140, a 1.7% lift from July and 1.2% above last year. In other words, prices aren’t spiking, but they’re quietly holding their ground.

“Despite a softer-than-expected home buying season this year, a bounce back in pending sales last month is an encouraging sign that sales could improve the rest of the year…Many prospective homebuyers have been holding out in hopes of lower mortgage rates, and the declining trend in rates observed in the last few weeks could be the nudge that draw them back to the market.” - C.A.R. President Heather Ozur, a Palm Springs REALTOR®.

Year-to-date sales are still trailing 2024 by 0.4%, and August marked the fifth straight month of year-over-year declines, along with the 35th consecutive month of sales staying under the 300,000 benchmark. Yet the undercurrent is shifting. Pending sales jumped 8.3% from July and even edged 0.2% above last year—the first annual bump in nine months—as buyers took advantage of easing rates.

Industry pros see the move as more than a blip. C.A.R.’s leadership notes that softer prices through early summer helped reset expectations, and the recent rate relief could be the nudge hesitant buyers were waiting for. If mortgage costs keep trending down—or even just stay put—we could see steadier price growth and a healthier balance between supply and demand as we head into the fall selling season.

“Soft sales demand led to a steady decline in California’s median home price for three consecutive months through early summer…However, with a slight uptick in the median price in August and a stabilization in the number of reduced-price listings last month, the market appears to have found a short-term balance between supply and demand. "If mortgage rates maintain their current levels or decline further before year-end, positive year-over-year home price growth may continue in the next few months." said C.A.R. Senior Vice President and Chief Economist Jordan Levine

Bottom line: the market’s not on fire, but it’s no longer on ice either. With rates cooling and prices holding steady, California real estate may be gearing up for a steadier, more confident close to the year.

And now for the latest data on Los Angeles County real estate trends:

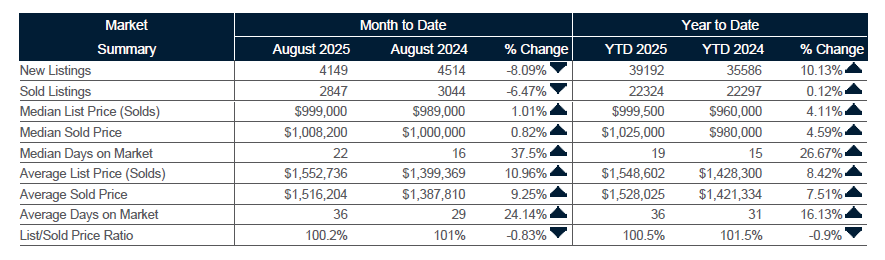

Single family homes | Los Angeles County | August 2025

New Listings: 4,149 (Down 8.09% year over year)

Homes Sold: 2,847 (Down 6.47% year over year)

Median List Price: $999,000 (Up 1.01% year over year)

Median Sales Price: $1,008,200 (Up .82% year over year)

Median Days on Market: 22 (Up 37.5% year over year)

Average List Price: $1,552,736 (Up 10.96% year over year)

Average Sales Price: $1,516,204 (Up 9.25% year over year)

Average Days on Market: 36 (Up 24.14% year over year)

List/Sell Price Ratio: 100.2% (Down .83% year over year)

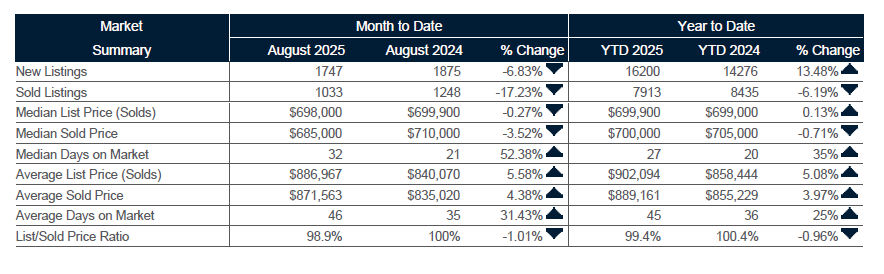

Condo homes | Los Angeles County | August 2025

New Listings: 1,747 (Down 6.83% year over year)

Homes Sold: 1,033 (Down 17.23% year over year)

Median List Price: $698,000 (Down .27% year over year)

Median Sales Price: $685,000 (Down 3.52% year over year)

Median Days on Market: 32 (Up 52.38% year over year)

Average List Price: $886,967 (Up 5.58% year over year)

Average Sales Price: $871,563 (Up 4.38% year over year)

Average Days on Market: 46 (Up 31.43% year over year)

List/Sell Price Ratio: 98.9% (Down 1.01% year over year)

Single Family Homes I August 2025 I Los Angeles County

Condo-Townhomes I August 2025 I Los Angeles County

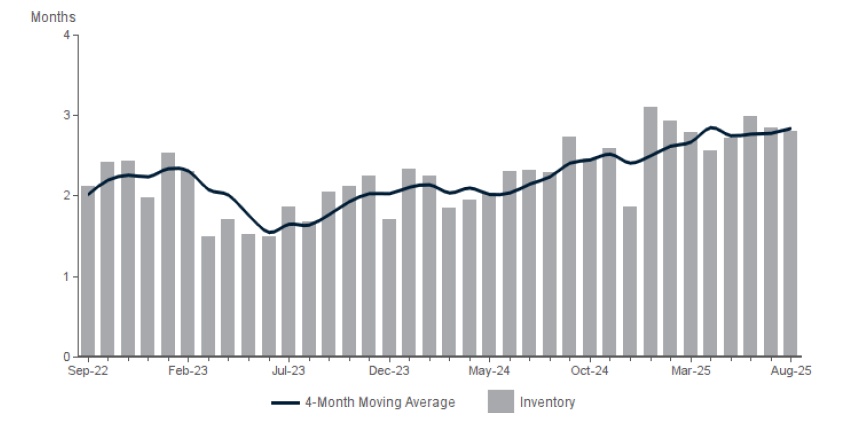

Single Family Homes I Months Supply of Inventory I Properties for sale divided by number of properties sold

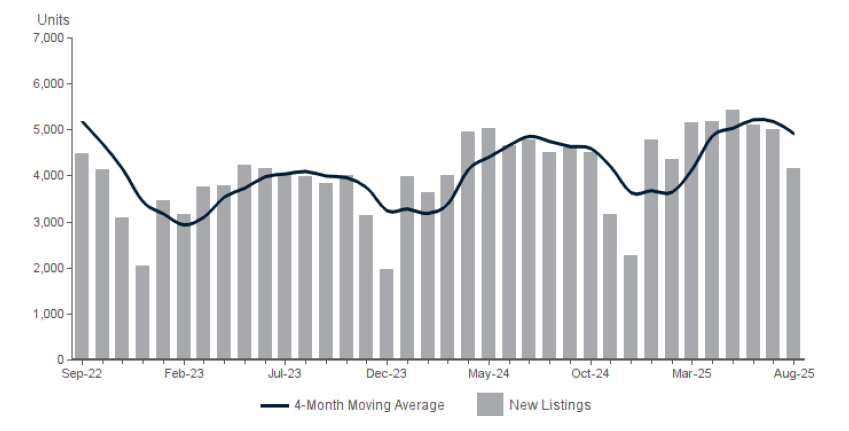

Single Family Homes I New Properties I Number of new properties listed for sale during the month

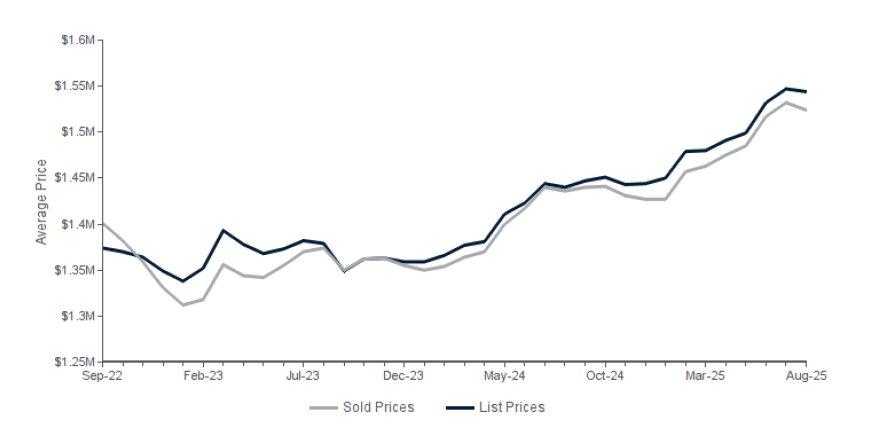

Single Family Homes I Average Sales/List Price I Average list price compared to average sold price of properties sold each month

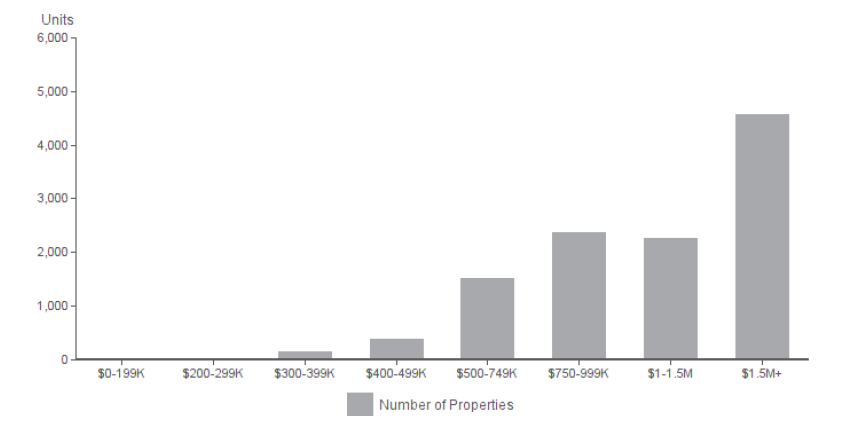

Single Family Homes I Properties for Sale I Number of properties currently listed for sale by price range

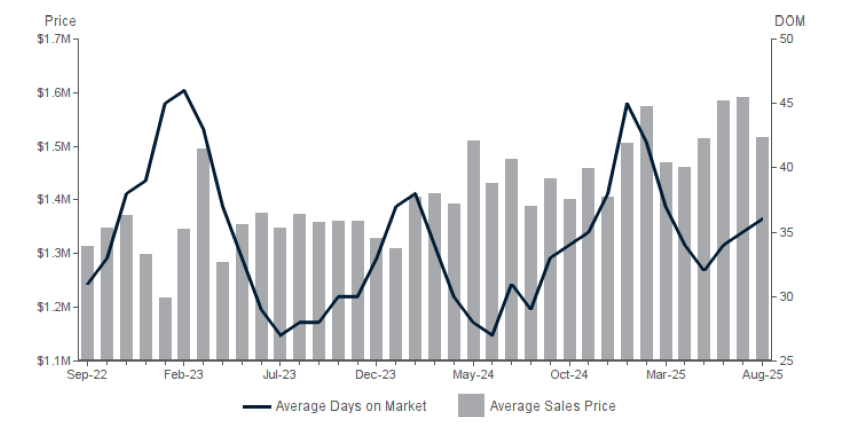

Single Family Homes I Average Sales Price and Average Days on Market

The statistics presented in the Market Report are compiled based on figures and data generated by IDC Global and Datafloat for the benefit of Rodeo Realty. Due to possible reporting inconsistencies, Days on Market (DOM), average prices and rates of appreciation should be used to analyze trends only. All information should be independently reviewed and verified for accuracy. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Data maintained by the MLSs may not reflect all real estate activity in the market. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information. |

Want to know what's happening in your neighborhood?

There's the state of California, the county of Los Angeles and then there's your neighborhood. If you would like a Real Estate market report for a specific zip code or neighborhood, complete this form and we'll be back in touch with you!

Thank you for reaching out!

We'll get in touch with you soon.